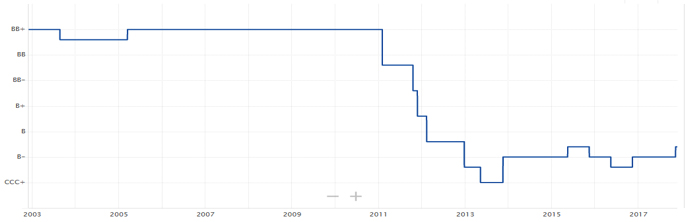

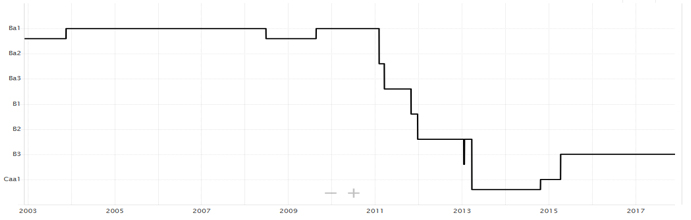

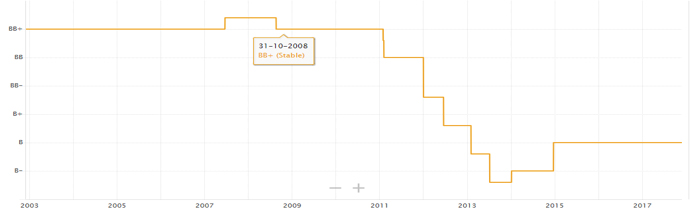

As shown in the three graphs attached to the report, Cairo has been enjoying a great deal of stability and continuous improvement in its ability to meet financial obligations and meet its partners dues between 2003 and 2011. Until the revolution broke out on 25 January, and then the situation turned upside down, the cash reserves collapsed by more than two thirds in its worst decline in our history. Followed by nearly zero foreign direct investments, and cash outflow. The volume of hot money (which we discussed above) was estimated at $10 billion.

In addition to deterioration of tourism revenues from about $13 billion to almost half or more with the continuation of sit-ins and class protests, GDP declined for the first time in more than 20 years towards contraction in the third quarter of 2011 by about 1% (contraction of reverse growth). We have lost more than $40 billion in the past years because of disturbances in the tourism and investment sectors only.

The import bill continued to grow as governments shuddered and were changed more than 9 times between 2011 and 2013. The confusion within the political order, the fragility of security stability in the society, the high rates of crime and weakness of the police authority, all added to an import bill that approached $70 billion dollars with the continued population growth rate (among the highest in the world) and with it an increase in People’s demands and requirements.

In the shadow of a cash reserve that reached the stage of danger and covers only less than 3 months of our import needs from abroad, as well as a budget that suffers from deficit, considered the largest in its history.

After years of a single figure deficit of 8%, the deficit increased to 10%, then 10.7% and then 13.3% in 2011, 2012 and 2013 respectively. At the same time, exports did not increase in a way that can hold the bleeding of foreign currency or improve the economy, hovering around the $18 billion dollars. All these reasons and more led to this collapse in our credit rating.

The following charts are for our rating history with the agencies: Standard & Poor’s first followed by Moody’s and Fitch finally.