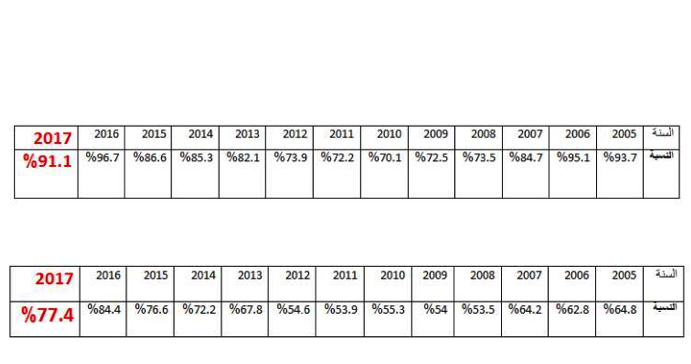

The ratio of Egypt’s total domestic debt to GDP fell from 96.7% to 91.1%.

The ratio of Egypt’s net domestic debt to GDP fell from 84.4% to 77.4%.

No researcher or specialist expected this success to happen so quickly. Most economists expected this change to happen by the end of 2018, and it was far from happening in 2017.

In the following lines, we will explain the meaning and indications of these numbers and percentages.

First: the debt as a single or fixed number has no meaning on its own and must be attributed to GDP, so that it may be evaluated. Is it in a safe or dangerous zone ? Are we going in the right or wrong direction? Are the government policies moving towards reducing the ratio or doubling it ?

Second: debt as a figure rose from 2.6 trillion pounds to 3.1 trillion pounds from June 2016 to June 2017, but gross domestic product rose from 2.7 trillion pounds to 3.4 trillion pounds from June 2016 to June 2017.

Third: What does the increase in the local GDP faster than the increase in debt mean? When we see in the news a formula that says “the rate of economic growth in a country reached a certain percentage” Economic growth here is the real GDP growth rate at constant prices.

The gross domestic product of any country is an indicator of the strength of the economy, which is the most common sign of the safety and sustainability of an economy. If the economy suffers from problems. Such as the case of Egypt in the third quarter of 2011 after the disastrous effects of the revolution on the economy, we suffered a contraction of Almost 1 %. This happened for the first time in nearly 30 years, like the cases of “Paraguay and Iceland” currently and South Africa from 6 months. However, the state of growth does not mean that the state has eliminated all of its economic problems and is in the ranks of developed countries rather than developing countries, but this only means that economic problems are shrinking and the economy situation is recovering.

Fourth: the Growth Domestic Product, GDP, constitutes factors that makes it rise or fall. Accordingly the equation is as follows: consumption + investment + government expenditures + (net exports and imports). We will assume that the first three elements will increase leading to a positive economic move that will reflect a significant growth. We will further assume that the difference between imports and exports shrinks, then the trade deficit balance will fall, and accordingly growth will increase … and vice versa.

Note: “All accounts are excluding inflation impact”

Fifth: We have examples of many countries, either advanced, emerging or mutable, characterized by high rates of debt to GDP, yet do not suffer from structural problems and the economy continues to work. Such as Japan, Turkey, United States, Germany, South Africa, Qatar and Saudi Arabia. Japan is the world’s largest economy with a debt ratio of around 260%, US 110%, Turkey 100%, Germany 80%, Qatar 150%, and many others.