Last week, Sharm el-Sheikh hosted the 2017 Africa Conference, marking the second session of the conference for the second consecutive year after the Africa 2016 Conference. According to the official website of the conference, Africa 2017 was held under the auspices of President Abdel Fattah El-Sisi from 7 to 9 December 2017. The Ministry of Investment and International Cooperation and the COMESA Regional Investment Agency were responsible for organising the event. The 2017 Africa Conference was based on the resounding success of the 2016 Africa Conference, which witnessed the participation of six presidents and more than 1,000 representatives from 45 countries. This year’s conference was characterised by exclusive presidential dialogue sessions between African Presidents and the Executive Chairman of the Conference, as well as organising the Young Entrepreneurs Day. The 2017 Africa Conference continues to be the leading business platform for developing new partnerships, meeting investors and achieving business and trade goals in Africa.

The 2017 Africa Conference welcomed 1500 eminent businessmen and leading entrepreneurs to discuss and explore investment opportunities in new projects. Also in attendance were companies that have achieved high growth rates in Africa’s private sector and government projects that require foreign direct investments (FDIs). The conference highlighted what is happening in large-scale regional projects, as well as political reforms that stimulate regional private sector and cross-border trade. The 2017 Africa Conference provided insight into new business opportunities for funds, banks and investors looking to expand their investment portfolios in Africa.

The conference was therefore a unique platform that offered an irreplaceable opportunity for companies engaged in business transactions and services. Strategic partners and service providers had an unprecedented advantage sitting at the same table with decision makers, discussing key transactions and business opportunities as they are disclosed. This year’s conference featured a day dedicated to leading start-ups and entrepreneurs, the day was full of business dialogues and presentations hoping to attract funding and partnerships for some of the most innovative projects, turning the event into a leading business platform for network building and setting-up deals.

Those in attendance were able to listen directly to the heads of African States and the continent’s most important corporate executives, watch presentations from executives looking for global partners and finance and meet more than 1,000 leading figures in finance, industry, policy making from Africa and the world. Furthermore, they could gain experience and insight into current and future developments in Egypt and Africa to identify new business opportunities and partnerships and encounter consultants, startups managements, investors and financing funds. It also allowed SMEs to grab the opportunity to present their projects through the “promotion sessions for startups” and build a business network at the reception on “Young Entrepreneurs” Day.

If we consider youth conferences to be a marketing tool for the economy and tourism in Egypt, then, the Africa conference had the impact of multiple youth conferences, in terms of development, tourism, investment, trade and the economy. This is clear for the following reasons:

For the first time in Egypt, we saw President Abdel Fattah El-Sisi on-air in an open dialogue for two and a half hours, along with African statesmen, executive managers, and investors from across Africa. Figures from prominent media platforms, such Nozipho Mbanjwa of CNBC and Lukwesa Burak of the BBC, were there to offer professional coverage and presentation. Furthermore, the conference assembled a selection of the top international economic figures such as Mukhisa Kituyi, the Secretary-General of the United Nations Conference on Trade and Development (UNCTAD); Roberto Azevedo, the Director General of the World Trade Organisation; Jim Yong Kim, the President of the World Bank; Li Yong, the Director of the United Nations Industrial Development Organisation (UNIDO); Bandar Hajjar, the President of the Islamic Development Bank; Benedict Oramah, the President of the African Export and Import Bank, and Jose Angel Gurria, the Secretary General of the Organisation for Economic Co-operation and Development (OECD).

The most prominent speakers were the Egyptian President, the Nigerian President, the Ivorian President, the Rwandan President, the Egyptian Prime Minister, the Mozambican Prime Minister, the Prime Minister of Ethiopia, the Egyptian Minister of Investment, the Secretary General of COMESA, the Chief Executive Officer of Egyptian Steel, the founder of the business incubator Flat 6 Labs, the Chief Executive Officer of the investment bank Hermes, the Chief Executive of Citadel, the Director of Uber’s Middle East and Africa Department, the Chief Executive Officer of Carbon Holdings, the Chairman of the South African Investment Authority, the Chief Executive Officer of Commercial International Bank, the Chief Executive Officer of First Bank of Nigeria, the Director of the department of Africa in Citibank Banking Group, the Director of North Africa at Nissan, the President of the European Bank for Reconstruction and Development, the President of the Waffa Commercial Bank of Morocco, the Co-Chairman of Abraaj Capital Investment, the founder and President of Jomia.com and the Founder of Rise up Summit for Entrepreneurship.

Investment opportunities in Africa

Agriculture

Africa has 60% of the world’s uncultivated land, however, the continent contributes to only 10% of the world’s agricultural production. Therefore, agriculture is considered as one of the most important investment opportunities in Africa that is not fully exploited and could be one of the most important sectors that may drive a rapid growth in African countries beyond the mining and mineral sectors.

It should be noted that Southeast Asia has become an expensive destination for agricultural investments, in light of which, the African continent has a great opportunity and the value added potential to earn from this situation. Ethiopia, which has the world’s most fertile lands, spends 25% of its budget on agriculture as it represents the main sector of its national income accounting for 50% of Ethiopian GDP and 85% of export earnings and employment. Uganda exports its agricultural products as raw materials (coffee and tobacco) without any serious attempts to introduce the value added chain within this sector to earn greater benefits and diversify its economy and income resources. Accordingly, African countries desperately need to maximise benefits from its current raw resources through a transfer of industrialisation to agriculture, and localisation of technology to maximise its revenues within this important sector.

As an example of the success of technology within Africa, Kenya, the leading African country in this sector, has established an electronic platform to showcase more than 1,400 agricultural crops for sale within and outside the country. Farmers have gained more and traders have saved the cost of troublesome visits to the farms. This was one of the most impressive applications of technology within the African agriculture sector.

Energy

The problem of energy scarcity is one of the major obstacles to growth and development on the African continent. A report by the South African Rand-Merchant Bank on the continent’s 2016 energy sector stated that 55% of Nigerians lack a stable and constant energy source and compensate for this by using generators. On the other hand, nearly 80% of the East African region is completely without electricity, whilst 90% of Liberians do not have basic electricity in their homes. As Liberia has 6 rivers, there is a clear opportunity to invest in the hydroelectric power generation sector. Accordingly, investment in the continent’s energy sector represents not only an opportunity but also a challenge with great value and returns for investors in this unique and untapped sector.

Infrastructure

Mauritius, the Seychelles, Namibia, Morocco and South Africa are the African countries with the best infrastructure. On the other hand, Libya, Angola and Guinea are the continent’s poorest countries in this sector. A Lack of facilities, services and poor quality negatively affect the prospects for growth and the future of the continent’s countries. Although Africa exceeded Asia in the establishment of power plants and new landlines between 1990 and 2000, since the beginning of the millennium there has been a huge and frightening recession in investments within this sector in Africa.

Egypt has turned its attention towards this sector and has focused on development and modernisation of its facilities and infrastructure, taking advantage of the current investments within real estate, tourism and construction. Along with the huge road project connecting Cairo with Johannesburg, passing through Sudan, South Sudan, Ethiopia, Kenya, Malawi, Mozambique, Zambia and Zimbabwe, with a length of 8,000 kilometres.

Retail trade

Retail is the fastest growing sector within Africa, with amazing annual growth rates and a steady contribution to the rise in the national income of the continent. Yet, consumer behaviours differ from one state to another, accordingly, investors should study each country separately in terms of population size, consumer culture, economic growth rates, challenges, absorptive capacity, market demand and supply.

Nigeria, Ethiopia and Congo are the fastest growing emerging markets in this sector. Likewise, the pace of urbanisation is very high in Burundi, Uganda, Niger, Burkina Faso and Malawi showing that profit opportunities in the retail sector are very high due to the rapid growth within these countries. In a report by KPMG and DeWitt Consulting, which focused on five countries with huge opportunities within this sector, the opportunities are as follows: “ 1) Algeria is characterised by high per capita income, high urbanisation movement and concentration of wealth in urban areas. 2) Ghana has a favourable business environment and a popular culture that promotes the idea of shopping and buying. 3) Kenya is characterised by a very high population growth rate as well as a rise of a middle class population and private sector growth. 4) Morocco’s population growth as well has a wider middle class population as well as an increase in urbanisation. 5) Nigeria is characterised by several factors, the first of which is the large size of the market (190 million people, the largest African nation in population) the second is the current large privatisation movement occurring now and the high percentage of young people in the population.

Communications

Companies that took the courageous decision to penetrate the African market have, for several years now, made huge earnings from this sector. For example, India’s Bharti Airtel invested in this sector in 15 African countries. They invested $1 billion in their operations within the African Continent and announced a profit of $13 billion in the fiscal year 2010/2011. The telecom sector still offers huge returns on investments with an increased demand, low supply and a steady population growth.

In Conclusion, the 2017 Africa Conference was an important platform for attracting investment, presenting the bright image of the continent to the world, highlighting the positive opportunities within the continent and presenting the various trade and investment potential of Africa. It was an important opportunity to exploit this great international gathering to the benefit of the African people.

Investment in Egypt and potential competition

Rand Merchant is a South African bank headquartered in Johannesburg; it has four branches outside Africa in Britain, India, Dubai and China as well as ten branches in African countries, mostly in sub-Saharan Africa. The Bank publishes an annual report called “Where to invest in Africa” to measure the investment environment and volume of cash flow attracted by the African countries and accordingly ranking countries on this criteria along with other criteria. The first report was issued in 2011 and since then, the Research and Studies Unit of the Bank had continued to follow-up on the progress of investments in Africa and its developments until the 2017 report was issued last September.

Report 2017

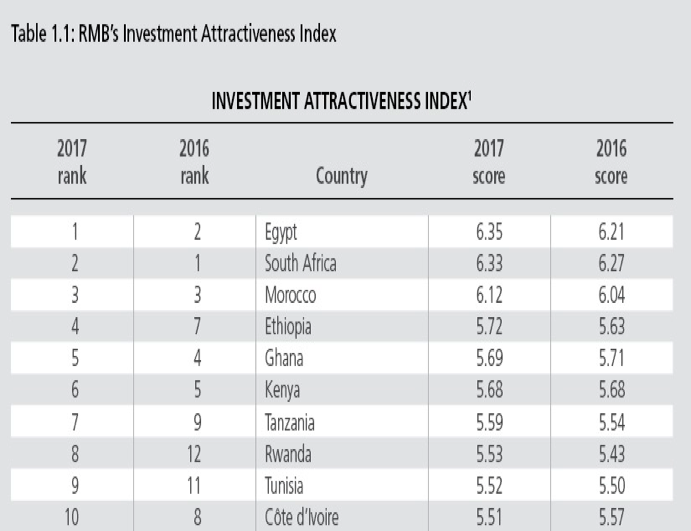

In this report, it was announced that for the first time in seven years Egypt has topped the continent’s charts in terms of attracting foreign cash flows in Africa.

The report has received wide international coverage, most notably shown by Bloomberg’s attention to the data and indications of the report and the continent’s new ranking.

The implications of the 2017 Report:

For the first time since the publication of the report, Egypt has topped the rankings, which was occupied by South Africa for years. Also, for the first time since the report was released, Nigeria fell out of the top ten, whilst Morocco maintained its third place for the third year in a row. Surprisingly, Ethiopia was fourth, replacing Kenya, due to its rapid growth of 7%. Ghana fell to fifth place due to corruption and weak economic freedom in the country, followed by Kenya and Tanzania in the sixth and seventh. Rwanda, which remains in the list of top ten countries for the second year in a row, ranked eighth thanks to progress of its economic reforms, which is regarded as the fastest in the world, in diversifying its economy. On the other hand, Tunisia ranked ninth, followed by Côte d’Ivoire, as for Algeria, the country moved from the tenth to the 15th. The United States and the United Kingdom are the most frequent countries to inflate investments in the continent.

Being the first report to be issued after the liberalisation of the exchange rate in Egypt, bearing in mind that the report evaluates the investments in US dollars and not in the local currency of the country, it reflects a major success of the economic reforms and the overall attractiveness of the Egyptian market for investors.

Why did South Africa descend?

The most important components of the South African economy are the Metal industries that account for 60% of South Africa’s export earnings, contributing to about 10% of the country’s gross national product and providing more than half a million jobs. Furthermore, South Africa was classified as the world’s largest producer of Plutonium in 2011, accounting for 80% of the world’s reserves, on top of owning 50% of the world’s gold reserves.

The story of deterioration started in 2011/2012 with the Miners’ strike, followed by a global decline in commodities prices. The country was also subjected to a severe drought, the worst in a century, that led to a decline in agricultural production. Signs of a political crisis came in December 2015 with an economic crisis, where President Jacob Zuma dismissed the Minister of Finance, Nhlanhla Nene, and temporarily replaced him with his deputy. Yet, the instability led to a deterioration of currency and many investors withdrew their money from banks for fear of a greater loss amid uncertainty about the future. There were strong opposition voices against the dismissal of the Minister of Finance, they called for Nene to return to his job in response to the desire of the market and parties, including the ruling party, and to calm and reassure investors. Four days later, the President dismissed the newly appointed minister and appointed Pravin Gordhan, who was in the same position from 2009 to 2014, accordingly the Minister of Finance in South Africa changed 3 times in 7 days.

According to Mohammed Nalla, director of research at Nedbank Investment, the dismissal of a finance minister after two days of service does not help South Africa’s reputation, international investors may think: Why did the president not make a deliberate decision first? On the other hand, Democratic Alliance leader and head of the opposition, Mmusi Maimane, said that this was a foolish act by President Zuma and that he played Russian roulette with the South African economy. The country’s unemployment exceeded 25% and a significant economic downturn, the first since 2009, led to a deterioration of the exchange rate by almost 100%. The government did not liberalise the exchange rate with its free will to attract investment and encourage industrialisation and exports, but currency deterioration came as a natural result to the country’s instability. Consequently the cost of borrowing has sharply increased with the country’s credit rating down. In February 2016, Pravin Gordhan said: “We cannot spend money we do not have. We cannot borrow beyond our ability to repay. Until we can ignite growth and generate more revenue, we have to be tough on ourselves.”All of the aforementioned events have led to the current decline of South Africa’s economy.

Nigeria is suffering

We must recognise the following before evaluating the Nigerian experience: Nigeria is the 12th country in the world’s list of oil producers and 11th in the list of holding the largest oil reserves, as well as, the 6th in the list of oil exporters. Its Annual oil revenues amount to $27 billion annually (2016) and it has cash reserves of $31 billion. In spite of this, growth rate of the economy recorded a reduction of 1.5% in 2016.

The cause of Nigeria’s economic contraction was due to the collapse of oil prices that started in 2014. In an economy that depends 90% of its revenues on this resource, Nigeria has certainly suffered a negative impact due to its non-diversified income resources and sole dependence on oil and as a result fell out of the top ten.

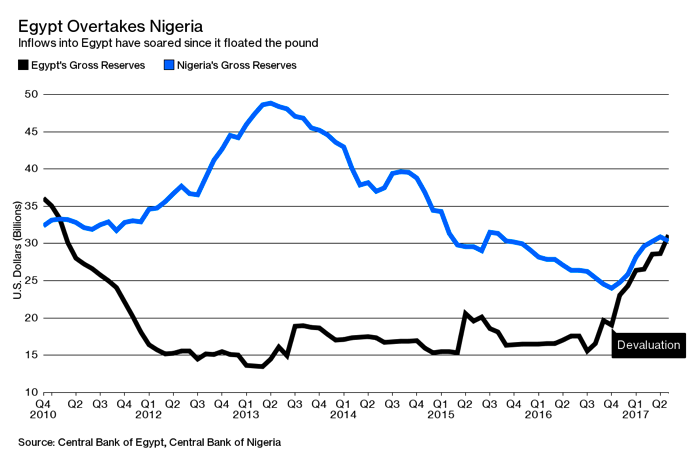

The dimensions of competition between Egypt and Nigeria at the top of the continent:

Egypt has liberalised the exchange rate completely, at the same time Nigeria has been hesitant about the same decision. The flow of foreign investments into the Nigerian market has declined, with Nigeria falling the 15th from sixth position last year. At the same time, foreign direct investments have increased in the Egyptian market by 26% and governmental investment of debt instruments have increased by 13%. In light of this, and as Bloomberg announced in one of its reports, the Egyptian reserves of $36 billion exceeded Nigeria’s reserves ($31 billion) for the first time since 2011.

The size of the Egyptian economy, with its purchasing power, exceeded its Nigerian counterpart (rich in oil) for the first time in the history of the continent. According to the International Monetary Fund statistics, Egypt has a gross domestic product of $1.197 billion, while Nigeria’s GDP stands at $1.124 billion.

Furthermore, Egypt’s growth rate reached 5% for the first time in 7 years, while Nigeria’s growth rate was half a percentage point. Nigeria fell into recession for a full year in 2016, for the first time in 25 years.

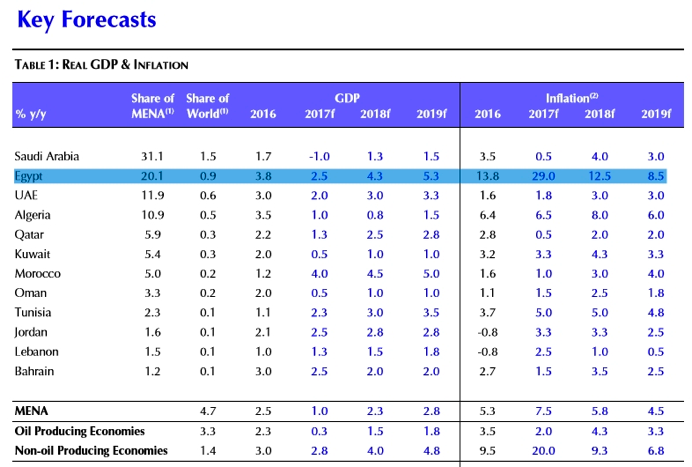

The World Bank’s annual World Development Report has forecasted that Egypt will be the fastest growing economy in the Middle East and North Africa region by 2018/2019.

While its outlook for the Nigerian economy was negative, due to its correlation with oil prices, expecting 2.4% and 2.5% GDP changes in 2018 and 2019 respectively.

As the Egyptian market enjoys diversity, the international institutions have been able to bet on its achievement of a 4.9% GDP growth rate in the last quarter of the fiscal year, with positive expectations in the years ahead. Based on the above, it was natural to see the regression of the Nigerian economy in front of the progress and achievements made by the Egyptian economy. There are clearly expected benefits for Egyptians in the coming period, assuming stability of all factors within the reform equation.

What are the expected benefits?

– Acceleration of gas production according to plans of companies and government

– The recovery of tourism revenues by continuing political and security stability

– The growth of foreign inflows with the adoption of the new investment law

– Inflation falling below 20% during the current fiscal year

– The return of interest rates to their investment-stimulating rates down 14% in 18 months

– The budget deficit falling below 10% in the current fiscal year (currently 10.9%)

– Public debt falling below 85% in the current fiscal year (currently 91.1%)

– Offering state-owned companies in the stock market

– Reform of the administrative apparatus of the State over the next 18 months

– Continuation of trade balance recovery

What other factors are supposed to be stable?

– Political and economic policies

– Quality of security services

– Relations with important trading partners (Gulf, Europe and China)

– In Libya – stability of the security situation so that it may not escalate to what is beyond the current situation.

– Success of the Palestinian reconciliation and its positive impact on border security

– Continued commitment of the government in implementing the required economic reforms

– Continued anti-corruption, monopoly and inefficient bureaucracy measures taken by the government.

It is also noteworthy that Ethiopia was ranked fourth in the investment report for the current year and recorded the highest growth rates in the world from 2011 to now (7 to 13%). Therefore, we must be aware of the significance and indication of these figures and link them to the international political and diplomatic move of the Ethiopian government regarding the Renaissance Dam. It is necessary to recognise the fact that Ethiopia is a rising country with a huge market of 100 million consumers (the second largest population on the continent after Nigeria) and has a great capacity for growth and development and there is a strong government and popular desire to do so and this explains much of the actions and policies pursued towards Egypt by the Government of Addis Ababa.