“Within 20 years, we will be an economy or state that doesn’t depend mainly on oil”

Saudi Arabia has decided to get ready for post-oil era by setting up the world’s largest sovereign fund. In a 5-hour interview with Bloomberg, Deputy Crown Prince Mohammed bin Salman discussed his vision on the $2tn public investment fund (PIF) that would help ending oil domination over Saudi economy.

Prince Mohammed bin Salman said that part of that strategy is to sell a stake- of less than 5 percent- in the parent of its state-owned oil company Aramco, in a move that could turn it to the world’s biggest publicly traded firm. The first initial public offering (IPO) is expected to be launched next year.

“IPOing Aramco and transferring its shares to PIF will technically make investments the source of Saudi government revenue, not oil,” the prince said in his interview at the royal compound in Riyadh.

“What is left now is to diversify investments. So within 20 years, we will be an economy or state that doesn’t depend mainly on oil.”

Thus, following 8 decades since oil discovery in Saudi Arabia, Prince Mohammed bin Salman wishes to change the world’ largest oil supplier to an economy that fits the coming period.

The prince said that Aramco’s IPO is planned in 2018, or even a year before that. Following that, the PIF will play a major role in the economy, through carrying out national and international investments.

The sovereign fund will be huge enough to buy Apple Inc., Google parent Alphabet Inc., Microsoft Corp. and Berkshire Hathaway Inc. – the world’s four largest publicly traded companies.

PIF ultimately plans to increase its foreign investments’ proportion to 50 per cent by 2020, said Secretary-General of the fund’s board Yasir Alrumayyan.

The structural change blueprint follows a series of measures, adopted last year, to curb spending and prevent the budget deficit from exceeding 15 per cent of GDP. At the end of December, Saudi authorities raised fuel and electricity prices and pledged to end wasteful budget spending, following the oil price drop.

More steps will follow those “quick fixes” as part of a national transformation plan, to be announced within a month. These comprise various procedures to raise non-oil revenues steadily – including fees and value-added taxes.

“We are working on increasing the efficiency of spending,” said Prince Mohammed. The government used to spend up to 40 percent more than allocated in its budget and that was reduced to 12 percent in 2015, he added. “So I don’t believe that we have a real problem when it comes to low oil prices.” Council for Economic and Development Affairs, chaired by the prince, oversees ministries including finance, oil and economy.

He pointed out the wealth fund already holds stakes in companies including Saudi Basic Industries Corp., the world’s second-biggest chemicals manufacturer, and National Commercial Bank, the kingdom’s largest lender.

It has already started to become more active abroad. Last July, PIF acquired a 38 per cent stake in South Korea’s Posco Engineering & Construction Co. for $1.1bn. In the same month, it agreed to a $10bn partnership to invest in Russia with the Russian Direct Investment Fund.

The fund has been hiring specialists for markets, private equity and risk management, said Alrumayyan, PIF’s secretary-general.

“We’re working now on different fronts,” he said. “Now the government is transferring some of its assets, lands, some of the companies to us. We have different projects in tourism and in new industries that are untapped in Saudi.”

He described the overseas investment plan as “very aggressive,” though said PIF would initially be skewed toward domestic assets by the addition of Aramco.

“Undoubtedly, it will be the largest fund globally,” the prince said. “This will happen as soon as Aramco goes public.”

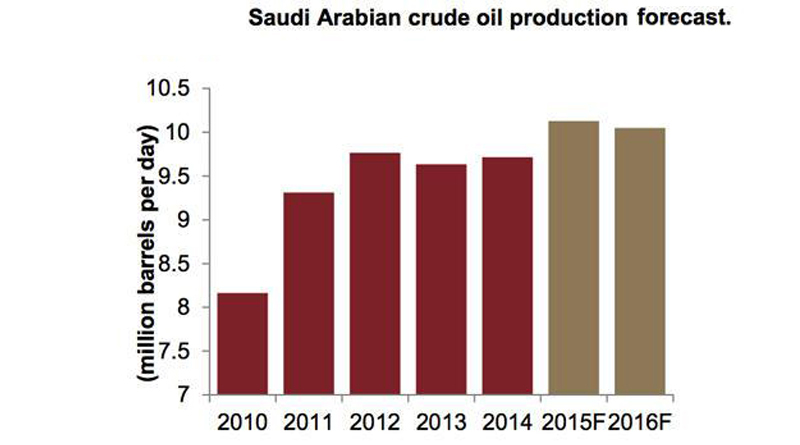

Regarding oil, the deputy crown prince said that Saudi Arabia will only freeze its oil output if Iran and other major producers do so, challenging Tehran to take an active role in stabilizing the over-supplied global crude market.

”If all countries agree to freeze production, we’re ready,” Mohammed bin Salman said. ”If anyone decides to raise their production, then we will not reject any opportunity that knocks on our door.”

When asked whether Iran needed to take part, the prince said “without a doubt. If all main producers decide to freeze production, we will be among them”. He pointed out that Saudi Arabia can survive the oil crisis by reforming its economy.

”I don’t believe that the decline in oil prices poses a threat to us,” he said, adding that any rise in prices, despite having budgetary benefits for the kingdom, would be a ”threat to the lifespan of oil.” Bin Salman suggested prices will rise over the next two years as demand continues to increase. He made clear, however, that Riyadh has very little appetite for the return of OPEC production management that molded the oil industry for 30 years.

”For us it’s a free market that is governed by supply and demand and this is how we deal with the market,” he said.

As for Aramco’s IPO, Prince Mohammed bin Salman said his advisers were working on a plan to offer shares in all of Saudi Arabian Oil company rather than just some of its refining subsidiaries. Saudi Aramco would be listed on the domestic stock exchange in 2017 and no later than 2018.

“The mother company will be offered to the public as well as a number of its subsidiaries,” the prince, who heads Aramco’s supreme council, told Bloomberg.

Moreover, bin Salman will give investors a stake in the world’s biggest oil fields and expose the assets that underpin the kingdom’s entire economy to unprecedented scrutiny. Aramco controls about 10 times the oil reserves held by Exxon Mobil Corp. and based on a conservative valuation of 10 dollars a barrel, the company could be worth more than $2.5tn.

The prince plans to make Aramco the world’s largest oil refiner, overtaking Exxon, mainly by adding capacity in Asia, as well as pushing further into petrochemical production.

“We will also announce Aramco’s new strategy and will transform it from an oil and gas company to an energy-industrial company,” he said.

The plan calls for listing a small stake on Tadawul, the Arab world’s largest bourse, the prince said. “We’re talking about less than 5 percent.”

The rest of Aramco would still be owned by the government, but controlled through a sovereign wealth fund.