JEDDAH: Saudi Arabia will not change course on its strategy of retaining market share and exports are expected to remain at around current levels for the remainder of this year and next year, according to a report released by Jadwa Investment.

Latest data available shows that year-to-August exports in the Kingdom were up 3 percent year-on-year, at 7.38 million barrels per day, below 10-year highs of 7.54 million bpd, recorded in 2012, Jadwa researchers say in their Quarterly Oil Market Update issued recently.

Both Saudi Arabia and Iraq saw the largest year-on-year increases in OPEC supply in Q3 2015 pushing the organisation’s output to a two-year high of 32 million bpd. The battle for market share within OPEC is likely to see output elevated at 32 million bpd in 2015 and 2016, contributing to keeping oil markets oversupplied, added the report.

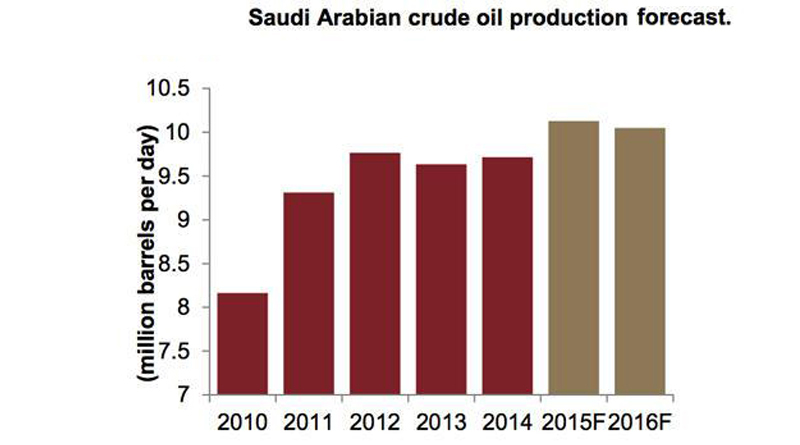

It said that OPEC data shows that Saudi Arabian crude production was up 5 percent year-on-year, averaging 10.2 million bpd.

The policy implemented by Saudi Arabia over regaining market share seems to be paying off with Saudi crude exports amounting to around 8.1 percent of the global market since November 2014, after falling to 7.9 percent in 2014, stated the Jadwa economists.

Maintaining market share is even more of a priority now for Saudi Arabia than when prices began to fall in the second half 2014, said the report.

Global oil markets are more competitive and the Kingdom faces competition from both within OPEC and outside it, it added.

“As a result, our 2015 forecast for Saudi oil production is at 10.1 million bpd and, even as non-OPEC supply slows in 2016, we see competition among OPEC members keeping yearly Saudi production at 10.1 million bpd in 2016 as well,” said the market update.

According to the Jadwa report, the glut in global oil markets has resulted in OECD commercial crude stocks rising, especially in the US, where rises in shale output and a ban on crude oil exports has seen record stockpiling. Stockpiling is expected to continue for the remainder of 2015, with some easing in 2016.

This combined with modest demand and continued supply increases will see global oil surpluses remaining above 1 million bpd in Q4 2015 but trending downwards throughout 2016. All of this means that there is little upside to oil prices until 2017.

“Our full year 2015 Brent forecast is therefore $56 per barel and 2016 forecast is at $61 per barrel,” said the report.

“Brent oil prices averaged $50 per barrel in Q3 2015 compared to $61 per barrel in Q2 2015 and we see little upside on oil prices considering global oil surpluses will remain above 1 million barrels per day in Q4 2015 and early 2016,” the Jadwa researchers added.

“Non-OECD demand is expected to hold up, regardless of the fragility in the Chinese economy, with yearly rises in Chinese oil demand forecast at 3.6 percent. Overall, the continued moderate pace of global economic growth will result in 1.4 percent year-on -year global oil demand growth, with similar annual growth rates in 2016,” it said.

“Crude oil output from non-OPEC sources dropped for the first time in four years, on a year-on-year basis, in Q3 2015, as low oil prices began to impact US shale oil growth. US crude oil production growth will contract at a more rapid pace in the last quarter of 2015 and show negative growth in 2016,” said the report.

Brent oil prices dropped 18 percent, quarter-on-quarter, in Q3 2015 as attention turned to the demand side of the oil market. Question marks were raised over Chinese economic growth while the International Monetary Fund downgraded its forecasts for global GDP growth in October, according to the Jadwa update.

Lower year-on-year oil prices have not jolted oil demand in Europe (14 percent of global oil demand), so far, as demand grew by a modest 1.2 percent in Q3 2015, year-on-year.

Structural factors such as improvements in fuel economy standards and low levels of economic growth have seen the region’s long-term oil demand trend downwards. As such, oil demand is likely to grow at similar rates in Q4 2015 but trend downwards in 2016.